QANTAS: Resumes paying dividend with profit jump in half year results

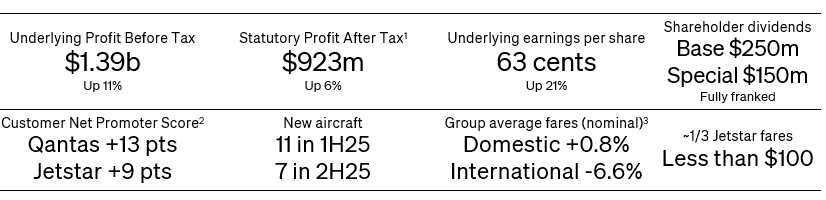

Qantas has indicated its first dividend payment to shareholders since the COVID-19 pandemic. The announcement came following a significant profit jump for the first half of the financial year. The result was driven by the airline’s low-cost subsidiary, Jetstar, and the efficiency brought to the airline with newer aircraft.

The base dividend of $250 million and a special dividend of $150 million cement CEO Vanessa Hudson’s turnaround plan. Hudson inherited an airline battling loud and prolonged customer dissatisfaction over high fares and deteriorating service. Regulatory scrutiny came in the form of selling tickets for no flights and illegally sacking 1,500 ground staff.

“Investing in our fleet is one of the most significant ways that we can transform the flying experience for our customers and make sure we’re … delivering a great journey.”

Vanessa Hudson, CEO Qantas

Content of this Post:

Fleet overhaul

Despite strong financial results, Qantas is still facing the substantial challenge of a significant fleet transition. On the domestic front, it is replacing some of its geriatric Boeing 737s with larger Airbus A321XLRs. When implemented, the airline will improve efficiency, delivering higher margins and that in the face of fierce domestic and international competition from Virgin Australia.

Delays in those aircraft deliveries, plus increasing demand, have goaded Qantas to refit 42 of its 75 Boeing 737s starting in 2027. By maintaining its Boeing 737s in the air despite their age, it will ease the strain on seat availability while it awaits their replacement with new Airbus A321 and A220 aircraft.

![Jetstar 787 Dreamliner current Business Class interior [Jetstar]](https://www.2paxfly.com/wp-content/uploads/2023/11/jetstar-boeing-787-dreamliner-businessseats1-6284271.jpg)

Improved results lead by Jetstar

Jetstar is important to the bumper results. Domestic earnings increased 54% compared to the previous year in the six months to December 31. The boost was driven mainly by the addition of eight new Airbus aircraft, enabling greater capacity and some route network expansion.

Qantas’ first next-generation Airbus A321XLR will arrive in June. Its smaller 717s will continue to be replaced by A220s as they arrive, delivering more efficiencies. However, Qantas acknowledged that the A220 fleet has yet to deliver the same economic benefits as the addition of newer, more efficient aircraft for Jetstar.

Financial performance

Revenues for Qantas’ domestic division rose 7% to $4.01 billion, and earnings rose 1% to $647 million.

On the international front, the freight division increased by 6% to $4.6 billion, and earnings increased by 2% to $327 million. However, International passenger fares dropped by an average of 6.6%.

2PAXfly Takeout

It looks like Qantas is coming out of a rough patch. After detonating its long-earned and highly marketable reputation with bad behaviour, seemingly led from the top by ex-CEO Alan Joyce, Vanessa Hudson seems to be providing the change required.

Having said that, if it were not for the sound financial base Joyce left, even after the devastation of the pandemic, Hudson’s task would have been much harder.

It will still take time to restore the airline’s reputation and continuing efficiency because aircraft once ordered don’t arrive tomorrow.

With a renewed focus on fleet investment, customer satisfaction, and operational efficiency, Qantas is positioning itself for long-term growth. The success of the airline’s renewal has been reflected in its share price. After sinking to below four dollars during the pandemic, it has more than doubled to close to the AU$9 mark recently—a happy development for shareholders like me.

TRANSPARENCY: The owners of this website have direct and/or indirect financial relationships with some or all of the companies named in this article. For further information, visit our Terms and Conditions.

What did you say?