QANTAS: Financial results – earnings down but demand strong

TRANSPARENCY: The owners of this website have direct and/or indirect financial relationships with some or all of the companies named in this article. For further information, visit our Terms and Conditions.

Qantas’s financial reporting today (29 July) shows earnings have fallen by 18% to AU$2.08 billion compared to last year’s record. Margins for domestic and international operations have missed targets. That’s likely because of the airlines increased spending on customer and service improvements. That investment was required due to the reputation trashing of the brand reputation under previous CEO Alan Joyce. That damage caused him to walk a few months earlier than agreed.

On a more positive note, Qantas predicts demand will remain solid. It also promises a return to paying dividends to shareholders in 2025. That will be the first time since COVID-19

Domestic Operations

These performed under the target of 18%. At AU$1.36 billion the margin is 14%.

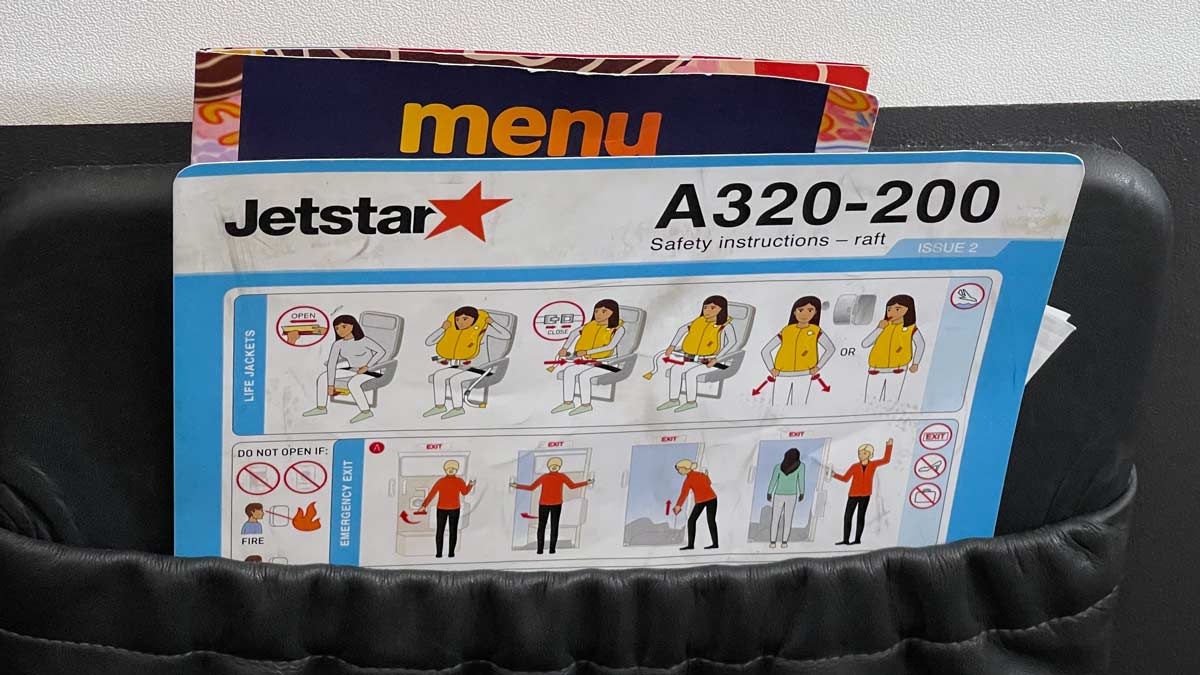

“Qantas benefited from increased corporate and resources travel and ongoing high demand for international premium seats while Jetstar delivered its highest result as it grew to meet increased demand from price-sensitive leisure travellers and saw the benefits from its new aircraft.”

Vanessa Hudson, Qantas CE

Twelve new aircraft have arrived for domestic operations during the period, which will provide greater customer comfort and additional cost and fuel efficiencies over time.

The airline is also confident about growth in the domestic sector, given an already upward trend of its market share against Virgin Australia, and the end of REX (Regional Express) flying on capital city routes since it went into administration in late July. Qantas goes so far as to predict a revenue increase of 2 to 4% in the first half of the financial year, over the previous year.

International Operations

Margins are also down here, coming in at 6.4% on a target above 8%. And it’s not expecting things to get better, with continued falls of 7 to 10% in the next half year due to increased competition from foreign airlines bringing additional aircraft back into service and more capacity into Australia. Qantas is optimistic that this decline in international revenue will ‘slow’ in the second half

Qantas Loyalty

Since the introduction of Classic Plus redemptions, which sit between Classic Rewards (the best) and its points-plus-pay (the worst deal for redemptions), it has seen massive points earning and redemption activity, resulting in income of AU$511

2PAXfly Takeout

There are not too many surprises here, and the stock market reflects that at the moment (10:30 am EST) with the stock price hovering around AU$6.33. Of course that may change during the day as analysts digest the report.

The airline’s results have been impacted by roughly AU$230 million spent on customer service initiatives after the brand trashing over its return to the skies post-COVID-19. That money has been spent on everything from IT enhancements to the app and website (seeing if your arriving aircraft is on time and the status of your baggage) through to some improvements in onboard catering, and the scheduling of more backup staff and aircraft.

That’s not the only cost either. Qantas is telling the market that it will incur about AU$60 million in additional costs in wages for flight attendants. To meet the current government’s ‘same job, same pay‘ legislation will mean that flight attendants’ wages will increase by 26%. Now, although that is portrayed as a cost, it can also be seen as how much Qantas was ripping off its flight attendant staff in the past.

Qantas has come up with a spray of media release announcements today as well as the financial reporting. I’ll work my way through these over the rest of the day. So expect a few more Qantas posts later in the day.

You’ve dogged out Qantas for years but demand is increasing. As I have said before there are millions of Qantas Frequent flyer members and they will remain loyal to the Qantas brand just like me.

Hi AA56,

Thanks for calling me tenacious. Such a compliment. I think the narrative around the performance of Qantas and its customers’ loyalty is much more complex and sophisticated than your comment suggests.