COVID-19: ACCC releases Airline competition in Australia report

The Australian Competition and Consumer Commission (ACCC) released its report on airline competition today.

Back in June 2020, the ACCC was directed by the Treasurer, Josh Frydenberg to monitor prices, costs and profits of Australia’s domestic airline industry, providing quarterly reports to government. The direction lasts for 3 years and gives the ACCC the ability to require information from Airlines including data and strategies.

Content of this Post:

Airlines – do no harm – to competition

Essentially the ACCC and the government could see the possibility of abuse given the COVID-19 pandemic and its dramatic effect on airline services in Australia. Virgin Australia’s need to go into administration, and consequent sale to Bain Capital, confirmed the concern, not to mention the moves by other airlines to take advantage of the situation.

The report starts by pointing out why competition in the airline industry is important:

A competitive air passenger transport services industry is vital to meet the needs of consumers and the

Airline competition in Australia – ACCC report

economy more broadly, especially for a large country as geographically dispersed as Australia. Rivalry

between airlines can encourage cheaper airfares, more favourable terms and conditions, better quality

in-flight services, more frequent services and a broader network reach. It may be that some airlines are

more successful at meeting the needs of passengers than others.

It then points out that Airlines might also engage in behaviour that might prevent competition:

Such conduct may result in rival airlines scaling back their services, withdrawing from the

Airline competition in Australia P1 – ACCC report

market or not entering the market to begin with. Passengers may then be faced with fewer services

from which to choose, have to travel at less convenient times and pay higher airfares than otherwise.

Industry developments that concern the ACCC

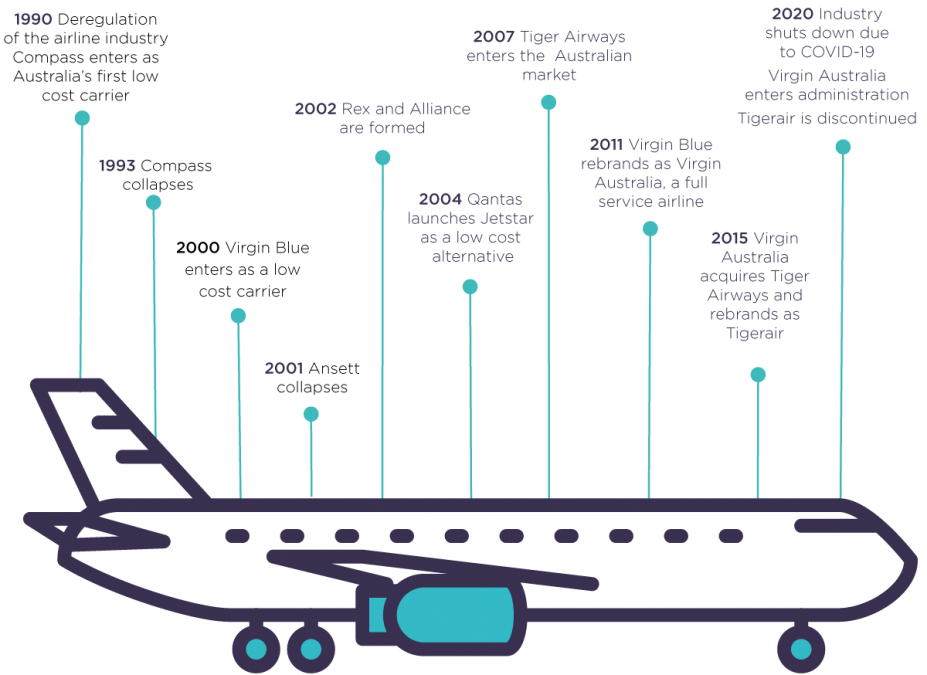

If you are a regular reader, then you are probably familiar with these developments. If you are not, then hopefully this chart below, taken from the report (P3) and starting with de-regulation in 1990 will get you up to speed.

The report notes that pre-COVID-19, the Australian airline industry was largely a duopolly with Qantas Group (Qantas & Jetstar) with 60% of the market, and Virgin Australia (Virgin & Tiger) with ~33%. During this period especially when Virgin Australia moved to a full service airline (2011) the capacity wars benefitted customers greatly, with lower prices and more flights available especially on busy routes like Melbourne/Sydney.

That level of competition wasn’t so good for the airlines profitability though.

Effects of COVID-19

Below is rather a telling graph illustrating the effect that COVID-19 had, especially during March and April on both capacity and passenger numbers for the industry. I travelled too and from Adelaide in March, and services were cancelled, and the flights I caught were less than 25% full.

The report details the the major events and initiatives the industry and government have taken in the 6 months since March, detailing the effects and consequent airline actions. Everything from the change in route structure, border closures, Virgin’s administration, and government financial support, amongst others.

What the airlines have to say

The ACCC’s consultations have revealed the following ‘key themes’, which the report neatly summarises and illustrates:

Most of this will be known to you, dear readers. The only point I have some issues with is the ‘Cheap flights’. It’s true that Qantas did release some extra cheap Jetstar fares early on but my monitoring of prices since then has revealed an increase in pricing rather than additional ‘cheap’ flights.

How will the ACCC know what is going on

The ACCC has some wide powers, so it will use the following to check on what is happening in the industry:

- monitoring

- reporting

- advocacy

- investigation

- enforcement action

It will use these powers to gain monthly information from the main players Qantas, Virgin and Rex covering:

- capacity (seats)

- utilisation (passengers)

- revenues by domestic route

. . . and that will underpin the ACCC’s analysis and reports to the public.

But that’s not all they will do. To dig deeper, the ACCC will sometimes ask for qualitative information, so it can dig a bit deeper in its investigation, depending on complaints from airlines, or whether it fears some concerning behaviour. I can feel the odour of censored board papers wafting past!

The ACCC will compile this information quarterly, and report to the Treasurer. It will act more swiftly and directly if it thinks there is a need.

We will be ready to recommend potential policy options, including potential regulatory protection for

Airline competition in Australia P9 – ACCC report

airline users, should there be signs that competition is not effective.

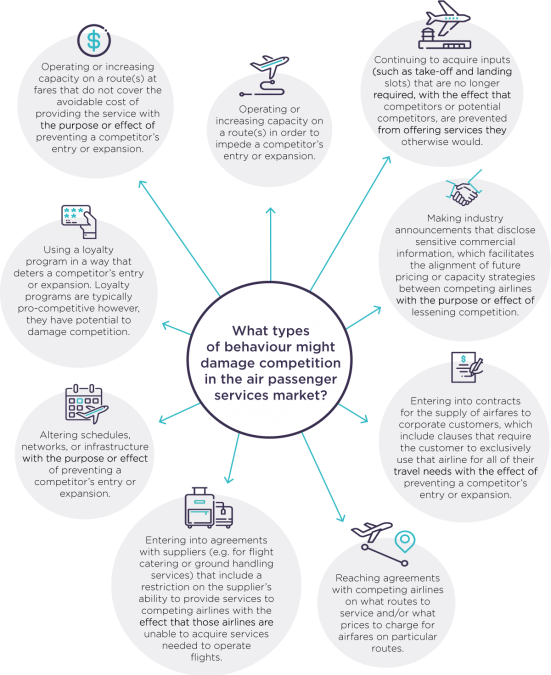

What will set off the alarm bells for the ACCC?

They are focussed on activity that affects competition and they include:

- capacity dumping

- predatory pricing

- airport slot hording

They have also compiled a neat little chart for the comprehension challenged (thats me!):

Airline activity already concerning the ACCC

There are already some industry activity that has been noticed by the ACCC – and they are monitoring:

Qantas stake in Alliance Airlines

Alliance Airlines is largely a charter airline – working a lot in the FiFo (Fly-in, Fly-out) market, but it has been engaged by some state governments to conduct subsidised routes. In fact Alliance offers the only competition on routes between Brisbane and Bundaberg and Gladstone, so the ACCC will be monitoring the ‘competitive dynamics’ between the two airlines.

In fact in news yesterday, Virgin Australia and Alliance Airlines have now dropped their flights between Brisbane and Bundaberg, leaving a monopoly to QantasLink. The ACCC will be onto that like an economy passenger with a unrequested free upgrade to business!

Industry complaints

The ACCC is not only talking about consumer complaints – although it has already intervened to make sure consumer understood their refund rights for instance. It also receives industry complaints alleging capacity dumping and predatory pricing – so it will be monitoring these carefully.

Short term industry coordination

COVID-19 throws up some strange challenges, including collapses in demand on vital routes considered essential to the public benefit. The ACCC has already given interim approval that will let REX coordinate flight schedules with competitors and share revenue on about 10 regional routes. In this case, the ACCC conditioned its approval on the fares for the routes being the same as those schedules in place on 1 February in 2020, and limited its permission until 30 June 2021.

2PAXfly Takeout

I will monitor the ACCC’s activity in the airline industry closely. They have extensive powers to ensure competition and fairness, and have not been afraid to use them in the past.

The airlines, and in my memory, particularly market leader Qantas have not been afraid to bend, if not actually break the rules, and they have been caught on more than one occasion by the ACCC.

My worry is that there are some things that are outside the ACCC’s remit. An example is Qantas CEO, Alan Joyce’s recent play to auction off to state governments with the highest bid the employees that come with the siting of various Qantas office maintenance and other facilities. Is there no end to the private sector’s ability to privatise profit and socialise losses?

What did you say?