Sydney Airport: Interim loss and AU$2 billion capital raising

Last Updated on December 11, 2023 by 2paxfly

We have spent a lot of time here at 2PAXfly on the fate of airlines during this COVID-19 pandemic. Not so much on the effect it is having on airports.

Content of this Post:

Sydney Airport announces loss

Sydney Airport announced an interim loss of AU$511 million today, the detail coming a week earlier than expected.

You can forget about any distribution for 2020 if you are a shareholder.

Despite having claimed back in May that it had enough liquidity to survive until the end of 2021, it has announced a capital raising for AU$2 billion to keep it liquid during the COVID-19 pandemic period – however long that may be.

‘We announce our half-year results today in a challenging environment. Whilst we delivered a solid start to 2020, the subsequent spread of COVID-19 saw the aviation industry deteriorate dramatically from late February.’

Geoff Culbert, Sydney Airport Chief Executive Officer

2020 interim financial results

With domestic traffic smashed by 95% it is no wonder that Sydney Airport has announced a loss. Here are their dotpoints from the report to the ASX:

- Loss after income tax expense was $53.6 million for the half year

- Passenger volumes for the half year were materially impacted by the COVID-19 related traffic restrictions implemented progressively from February 2020

- Sydney Airport welcomed 9.4 million passengers for the half year, a 56.6% decline on the prior corresponding period (pcp). Total passengers in 1Q 2020 was 9.0 million, down 18.0% on pcp. Total passengers in 2Q 2020 was 0.4 million, down 96.6% on pcp.

- International passengers declined by 57.3% and domestic by 56.1% on the pcp

- Earnings before interest, tax, depreciation and amortisation (EBITDA) was $300.4 million, down 35.4% on the pcp

- Net operating receipts (NOR) were $90.4 million, down 79% on the pcp

- Operating costs for the first half decreased 20.5%1, with savings tracking in line with the cost reduction plan

- Capital investment was $152.8 million, delivering critical projects targeting asset resilience, safety and security

- Strong balance sheet, credit ratings at BBB+/Baa1 (negative outlook) and financial flexibility with over $2.6 billion of liquidity. This will be increased to $4.6 billion following the Entitlement Offer announced today

That 96.6% drop on the prior corresponding period in Q2 of 2020 is the real kicker. And the rest of the results are not any better. Sydney Airport must be frantically looking at cutting costs, including staffing.

With state border closures and international travel not looking like a remote possibility until at least after Xmas 2020, things won’t get any better in the next 6 months. Providing nearly AU$53 million in rent relief to its retail and property tenants gives you an indication of how badly retail is doing at the airport.

An empty airport, few flights, airport hotels less than half full, fewer cars paying those lucrative parking fees and more than two-thirds of retail closed is the visible manifestation of these dire times for airports.

Cost Cutting

Well, you can kiss goodbye to the planned bathroom upgrades, southern expansion to T1, Pier A at T1, T2 retail redevelopment and south-east sector Aprons. If I was a Sydney Airport employee, I would also be nervous, as the airport wants to reduce costs by a third with a target date of March 2021. And that must mean staff cuts if they are going to reduce operating costs.

Capital raising/Entitlement Offer

A year ago, Sydney Airport was lovely and profitable, recording an interim profit of AU$199.8 million, including over AU$40 million provision for doubtful debts – which I think was probably code for ‘Virgin Australia’.

Today, Sydney Airport (SYD) is trying to raise equity of AU$2 billion (US$1.44 billion), which will reduce the airport’s current net debt to AU$7.1 billion from AU$9.1 billion. According to the documents of the offer, that will give it liquidity of AU$4.6 billion, which includes a billion of cash.

The offer price is AU$4.56 per New Security, which is a 15.4% discount on the closing share price of AU$5.39 on 10 August 2020. Sydney Airport shares are currently in a trading halt until 14 August.

Risks

Where do I start?

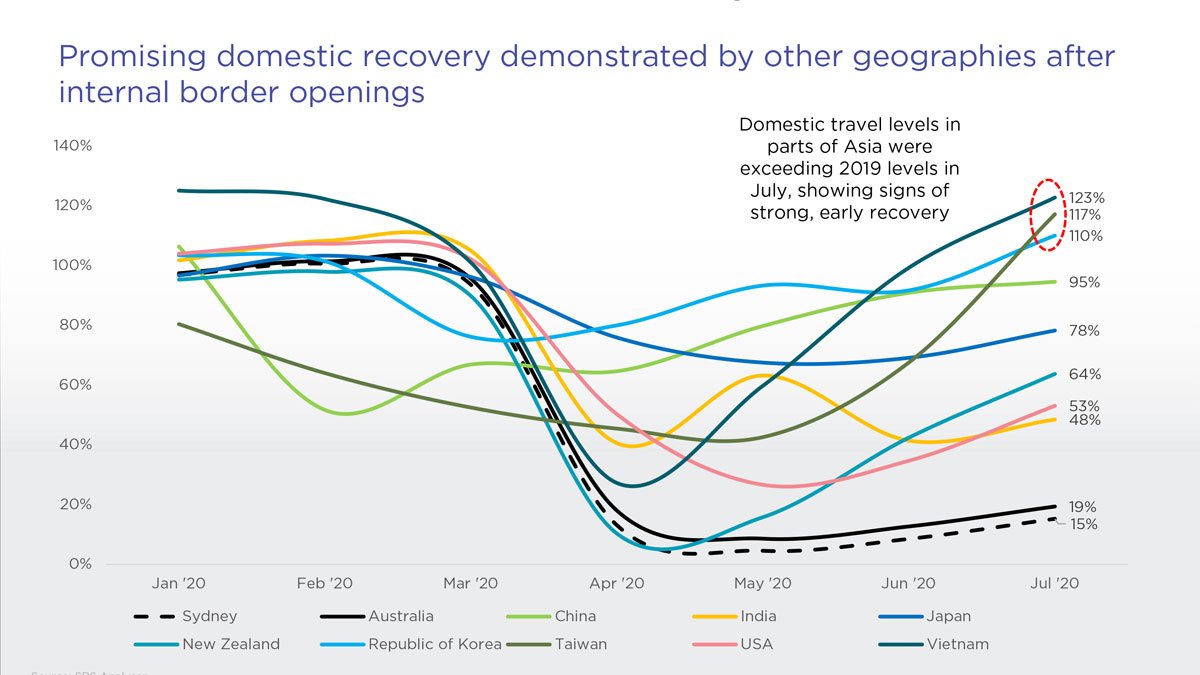

The pandemic throws up so many questions and so few answers about the fate of air travel, and hence Airports. When will domestic travel recover? SYD is using some optimistic figures from Taiwan, Korea and Vietnam to show that domestic travel levels might recover and exceed 2019 levels. [see above graph]

On international travel, it is hoping for the creation of ‘bubbles’ in the short-term. It hopes those ‘bubbles’ might be created between Australia and New Zealand and the Pacific Islands. Further afield, Japan, Korea, Hong Kong, Singapore and Canada are also options.

In terms of overall recovery, SYD is using data from IATA (International Air Transport Association) which predicts (hopes?) air travel will return to 2019 levels by 2024.

If you want to find out more about the risks, then find the presentation, and look for Appendix B

‘The spread of COVID-19, its effect on the global economy and the actions taken in response by the Australian and other governments, including border controls and travel restrictions, and the effects of the pandemic on the global economy have had, and are likely to continue to have, a material adverse effect on SYD, its financial performance and position, liquidity, financial condition and results of operations. It is also likely that there will be further unforeseen negative impacts as COVID-19 continues to spread of an as-yet unknown magnitude and duration.’

Sydney Airport Presentation 11 August 2020, Appendix B

Wordy, legalistic, not reader friendly it might be, but accurate, it is.

2PAXfly Takeout

This is another timely reminder to wear your seatbelt when seated. Holding you close to your seat will protect you from the sort of injuries sustained on this flight, when unsecured passengers flew to the ceiling of the aircraft, and then came crashing down once the ‘drop’ ceased.

The hope will be that this is an anomaly – a ‘freak accident’ in casual parlance. If it is a systemic error either mechanical or electronic, then this is a larger concern for the airlines that fly Boeing Dreamliner 787 aircraft. Let’s hope it isn’t. If it is, it will pile on the woes to Boeing’s existing stack.

Sydney Airport is not the first, and it won’t be the last air industry related business to need to get out there and capital raise to shore up its liquidity as a consequence of this pandemic.

Go talk to your financial advisor as to whether this is a good offer or not. I don’t claim any expertise on these matters.

What I will say, is it wouldn’t surprise me if things get worse before they get better, for both travellers, airlines, and airports.

What did you say?