Velocity: Global wallet – points down, fees up

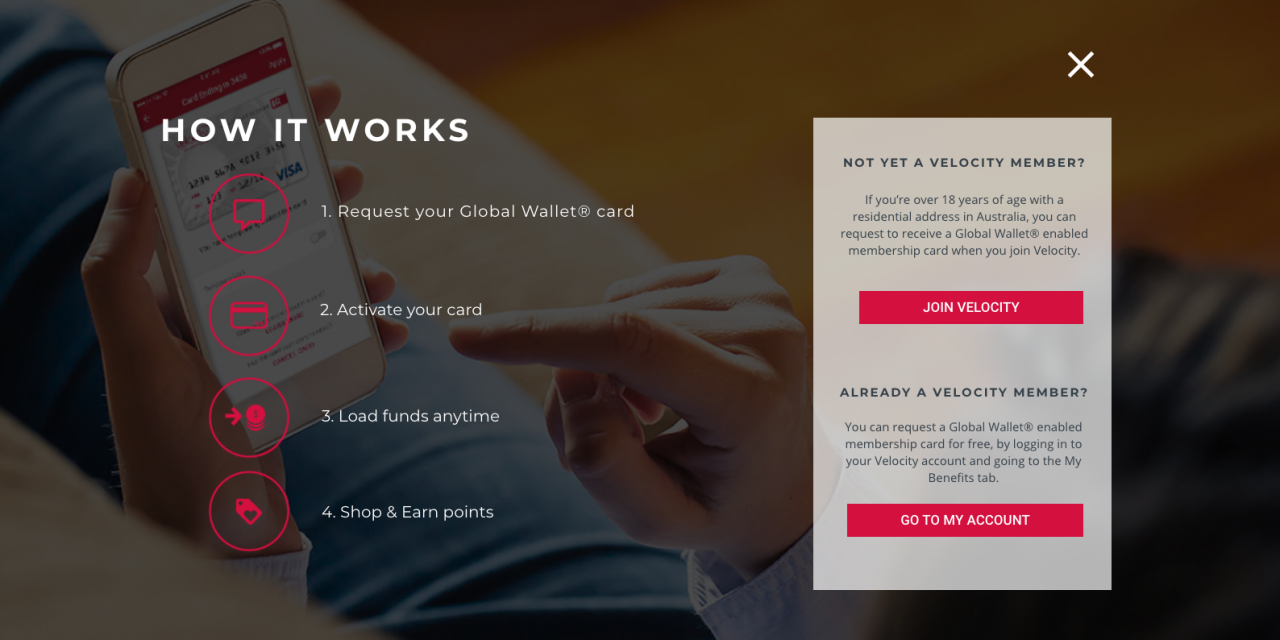

You will probably find that on the other side of your Virgin Australia frequent flyer membership card, there is a Velocity Global Wallet debit card, that you very well may not have activated. Well at least I haven’t activated mine.

Content of this Post:

Introduction

The reloadable Visa Prepaid Travel card, or Velocity Global Wallet, allows you to earn Velocity points and brags that you will earn more points on overseas spend with it, than with any other Australian issued prepaid card.

You can load up to AU$25,000 onto the card from your bank account and earn x2 Velocity Points per AU$1(equivalent) spent overseas, and 1 point for every AU$3 you spend in Australia. Or at least you could.

It’s all about to change

The Velocity Global Wallet is about to change points earn rates and rules, and I know this will come as a complete surprise, the earn rates don’t really benefit card holders! Velocity is also streamlining its fee structure, by eliminating quite a few, and, you guessed it, raising others. You can access a full summary of the changes at their Notice of Change to Velocity Global Wallet PDS. Good luck with all that fine print.

Here is a summary of the changes to come into effect on 4 May 2020:

- T&C’s now include virtual and digital cards as well as the physical card

- New earn rate for purchases in Australia has been downgraded to 1 Velocity point for every AU$4 spent – up from AU$3

- You don’t earn on all spend overseas anymore. This downgrade means only spend categorised by them as ‘Travel’, ‘Entertainment’ and ‘Everyday Shopping’ qualifies to earn points. God help you finding out how your spend is categorised at the little Italian Gelateria you frequent.

- They are now reserving the right to change the categories, earn rate, and other effective downgrades by just giving you 30 days notice

- Don’t f**k with them by putting your business spend on the card, or opening multiple accounts, using the card for gambling or ‘unlawful’ activities etc, ’cause it will end in tears with a refusal to credit. And they don’t even have to prove it, they just need reasonable grounds to ‘believe’

- They are nixing the current AU$10 supplementary card request fee and the AU$1.95 withdrawal fee (no points are earned on cash withdrawls anyway)

- Currency conversion fee has been eliminated – you know when you want to spend in UK£, and you only have Euros in your account

- Inactivity fees – changing from flat AU$1.95 to 0.5% of the total balance – with AU$1 being the minimum fee.

That’s most of the changes, although there are some arcane rules about limits recharging from Visa and Mastercard, which seem to be about preventing double-dipping. Also be aware, that your money is not actually held by Virgin Australia of Velocity. Funds are actually held by Cuscal Limited, and managed by Rêv a fintech that seems to specialise in this kind of Global Wallet service

And now for some History

In researching this post, I came across this little table which shows a raft of changes way back in 2017 – mostly to the benefit of users:

| Product proposition / Fee | Existing | New | Effective date (activated prior to 01/09/2017) | Effective date (activated after 01/09/2017) |

|---|---|---|---|---|

| International earn rate | 1 Point for AU$1 | 2 Points for AU$1 | 1 September 2017 | 1 September 2017 |

| Domestic earn rate | 1 Point for AU$2 | 1 Point for AU$3 | 1 October 2017 | 1 September 2017 |

| Aggregate funding limit (12 month rolling load limit) | AU$75,000 | AU$100,000 | 1 September 2017 | 1 September 2017 |

| Foreign exchange fee | 3% | 2.25% | 1 September 2017 | 1 September 2017 |

| Inactivity fee (only charged after 12 months of inactivity) | AU$1 per month | AU$1.95 per month | 1 October 2017 | 1 September 2017 |

| Domestic ATM fees¹ | Free | AU$1.95 | 1 October 2017 | 1 September 2017 |

| International ATM fees¹ | Varies depending on country | AU$1.95 | 1 September 2017 | 1 September 2017 |

| Load fees – Bank transfer | Free | Free | 1 September 2017 | 1 September 2017 |

| Load fees – BPAY | Free | 0.5% load fee for BPAY to AUD wallet. No load fee for BPAY to foreign currency wallet set as your preferred load wallet | 1 October 2017 | 1 September 2017 |

| Purchases excluded from Velocity Points earn | ATM withdrawals, quasi cash transactions, fees and charges, account adjustments, reversed transactions and gambling transactions | ATM withdrawals, quasi cash transactions, payments made to the Australian Taxation Office or other national or local Australian tax authorities, fees and charges, account adjustments, reversed transactions, gambling transactions and business transactions. | 1 October 2017 | 1 September 2017 |

2PAXfly Takeout

Personally, I’m not a fan of these Wallet type cards. I don’t think they offer great conversion rates, but do provide great complexity in terms of their fees and charges and now with this Velocity version, ridiculous complexity depending how the merchant you’re dealing with is categorised.

The question of what credit card, or cash card to use overseas is a constant dilemma. Lets face it, the banks are gonna get you ‘one way or another’ as Blondie sang.

On the other hand – who needs a Travel Wallet card at the moment when we are hunkered down in self isolation, and airlines are about to fall like skittles!

What did you say?