Qantas: Service fees increase. Credit card caps double!

While most of Australia is on holidays or escaping bushfires, Qantas has quietly increased a range of fees. See below for details:

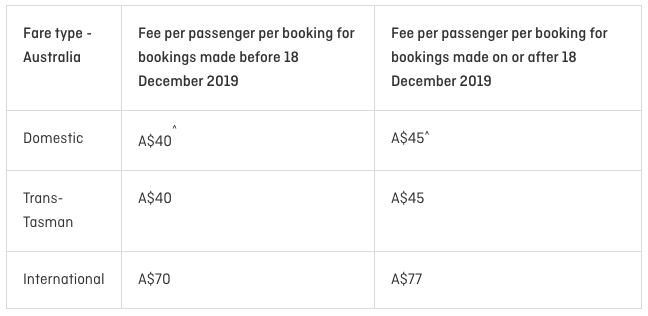

Booking and change fees increase

If you use a method other than via the Qantas website or could have, then domestic booking fees go up by 12.5% – not exactly in line with inflation which is currently in Australia at 1.96%. Neither are they inline with the recently agreed annual wage rise for Project Sunrise pilots of 3%.

For international bookings, the change is only 10% (AU$70 to AU$77).

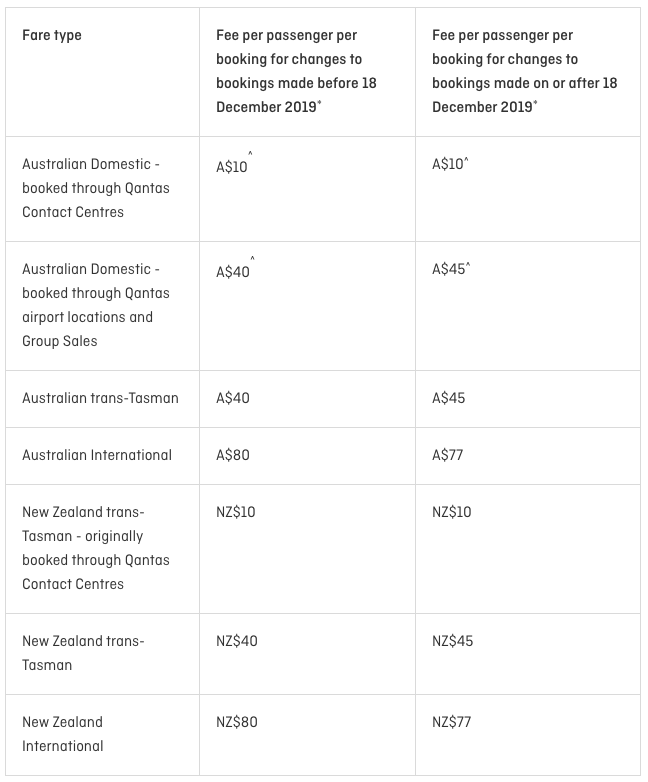

Change booking fees go up similarly (see table below), but note that there is actually a reduction of AU$3 for change fees on Australian and New Zealand international fares (AU$80 to AU$77).

If you are unable to make these bookings or changes via the Qantas website, and you resort to phoning or contacting Qantas by other means, then there continues to be no charge.

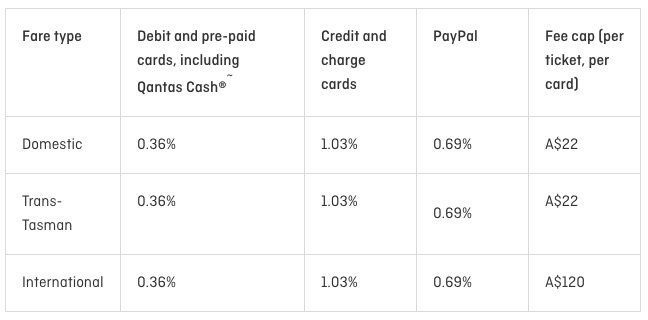

Credit Card Fee caps double!

Qantas isn’t actually increasing the percentage they charge, they are increasing the ‘cap’ they are placing on fees – for domestic and trans-Tasman fares from AU$11 to AU$22, and for international, fees go from AU$70 to AU$120 – AU$20 shy of doubling.

Current percentage charges for payments are:

- 0.36% for debit cards

- 1.03% for Credit cards

- 0.69% for PayPal

Maybe we should all change our payment method to PayPal, and link our most profitable points card to that for payments to Qantas and save 0.34%!

The other alternative is to pay using Qantas Gift Vouchers which do not attract that 0.36% fee. Although, do not use points to redeem from the Qantas Shopping Rewards Store, as this is almost universally a bad use of points. Also note that there are restrictions on what you can use the vouchers to pay for. They can’t be used for:

‘… multi-city, Classic Flight resords or Points Plus Pay flight bookings, or redeemed for cash or other gooda sn services such a additional baggage or seat selection.’

Qantas Gift-Voucher terms and conditions

Australian Consumer Law

Australian Competition and Consumer Commission (ACCC) has previously questioned Australian airlines about exactly these kind of charges. I am sure that Qantas has legal’d the bejesus out of these new fees, but I will still be interested in what the ACCC has to say on these increases. Its usual view is that such charges need to reflect the actual cost of processing, rather than some kind of figure plucked from the air. I’d like to know the reasoning behind the roughly doubling of credit card caps.

2PAXfly Takeout

I find these fees and charges highly annoying. I view them as just another form of income grabbing. If they were avoidable through another form of payment, then OK, we have a legitimate choice, but since they apply to every type of payment, where is the choice?

Well, I’m glad I got that off my chest. In the scheme of things, other than the $120 cap charge for international credit card payments, they are not huge. I would however be interested in seeing how these charges actually relate to the processing fees, to time charges involved in the actual execution of such credit card processing.

What did you say?